Introduction

This analysis looks at Colorado’s current employment landscape, and how it has changed over time. In particular, it looks at how employment changed from 2021 to 2022, as well as comparing 2022 to 2019 as a comparison to where the state was prior to the pandemic.

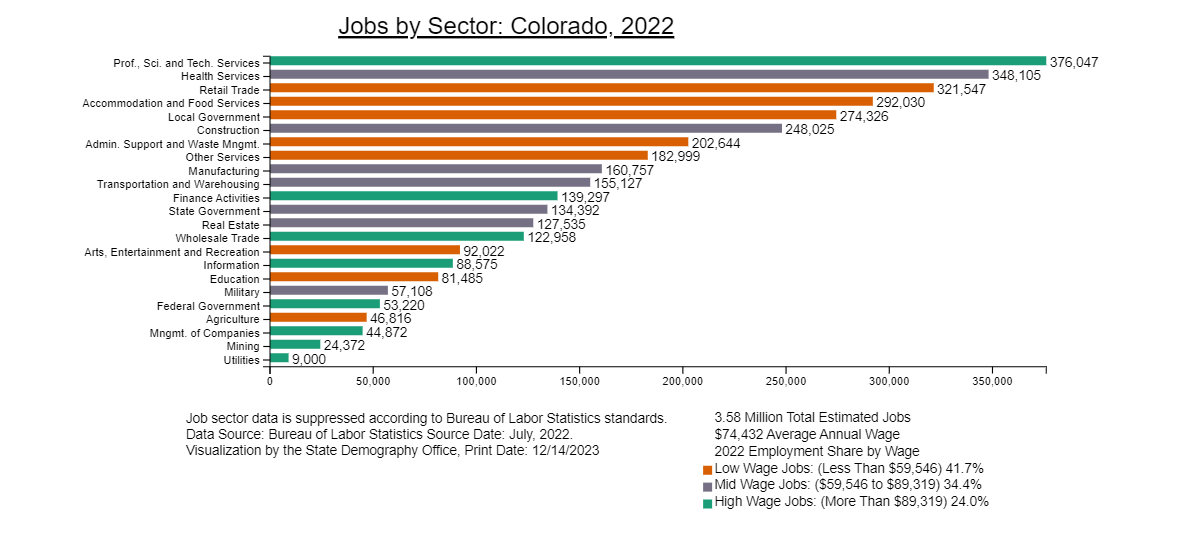

This chart shows the 2023 Jobs Profile for Colorado.

This chart, along with others in this report, are available in the

Jobs Sector Chart

application available on the

Economy and Jobs Applications resource page

of the State Demography Office Website. Underlying jobs data can be accessed through the

County Jobs by Sector Lookup application.

Total Jobs Over Time

From 2021 to 2022 Total Jobs as estimated by the State Demography Office increased by 128k, or 3.7%. The rapid pace of growth, however, was largely driven by recovery from the pandemic.

Compared to 2019, Colorado's total job count experienced an increase of 2.5% (87k jobs). This period includes a notable decline in employment in 2020 due to the pandemic, followed by a robust recovery.

Industries in Colorado

One of strengths of Colorado is its ability to attract a diverse range of companies and employees. The chart above shows the total number of Coloradans employed by each industry as tracked by the State Demography Office as of their 2022 estimates. The strength of the Professional, Scientific, and Technical Services sector in Colorado should be noted as the concentration of this high wage industry in the state makes Colorado unique.

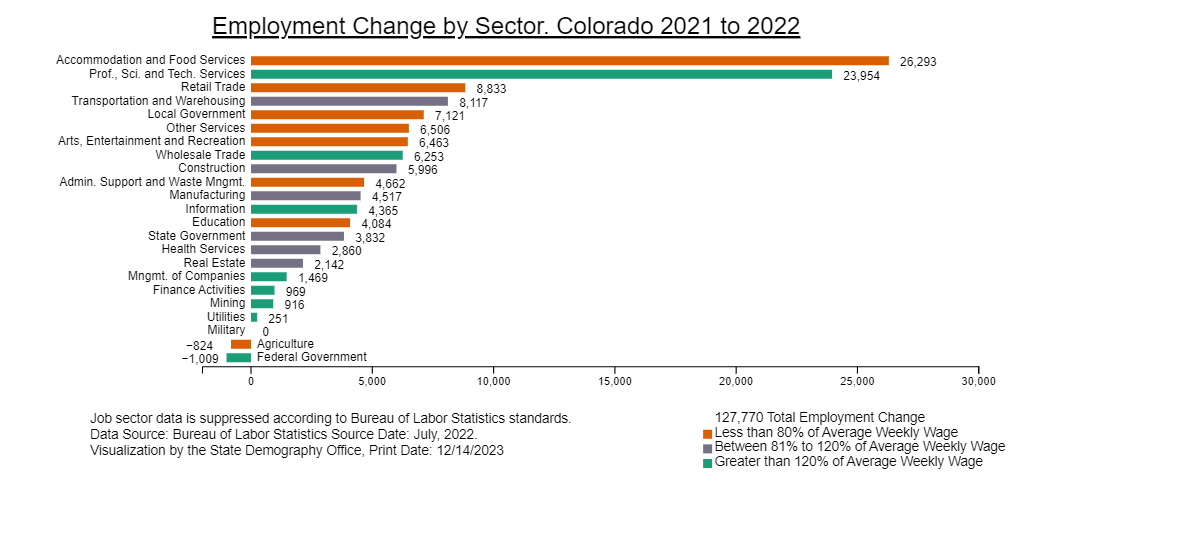

This chart shows changes in Jobs sectors for Colorado, 2021-2022.

Industry Changes

Between 2021 and 2022, most industries demonstrated growth, with Accommodation and Food Services showing an especially significant rebound. This sector alone added approximately 26,000 jobs, marking a substantial recovery from the previous year. Even with this strong growth, however, the industry was still below its 2019 level due to especially large losses in 2020. Only Agriculture and Federal Government saw declines in employment.

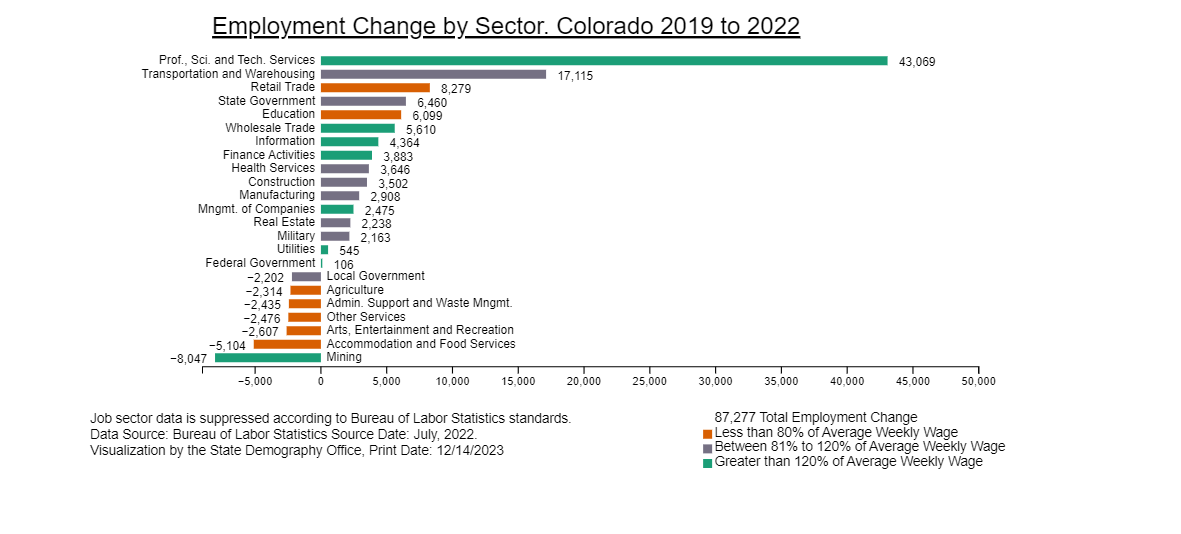

This chart shows changes in Jobs sectors for Colorado, 20191-2022.

Looking at the overall trend from 2019, Professional and Business Services, and Transportation and Warehousing sectors experienced the largest job growth. The former added about 20,000 jobs, while the latter saw an increase of around 12,000 jobs. These changes are attributed to the shift towards remote work and the growing reliance on technology and online services.

Other industries have not fully recovered from the pandemic – notably Mining, and Accomodation and Food Services both saw declines in excess of 5k jobs.

Job Changes by Region

Job growth in Colorado varied significantly by region. The Front Range, especially the Denver Metro area, experienced the most substantial increases in employment, adding over 88k jobs (4.2%) since 2021, and 63.5k (2.9%) since 2019. The Northern Front Range and Pikes Peak regions also saw significant gains in both periods. Together these 3 regions accounted for around 90% of total job gains in the state over each period.

In contrast, many rural regions, have not seen the same pace of growth. While all regions had at least some job gain between 2021 and 2022, four regions have current job levels below where they were in 2019, including Northeast Colorado, Rural Resort Region , Southeast Colorado, and South Central Colorado. This highlights the uneven nature of economic recovery across different regions.

Conclusion

Overall, Colorado's job market has not only recovered the jobs lost during the pandemic but has also created new opportunities. The total job count in the state as of 2022 exceeds the pre-pandemic levels, signifying a resilient economy. However, the recovery has been uneven, with some industries and regions still grappling with lower employment levels than they had prior to the pandemic.

See the full paper here:Total Estimated Jobs 2022: Colorado's Employment LandscapePlease contact the SDO team if you have any questions about the population of Colorado.